This will hide itself!

Open APIs for

Unmatched Scale & Security

Features

Improve your API experience with privacy, scalability, migration tools, job management, CLI support, and cutting-edge experimental features.

Ensure data security with our privacy-centric approach to API management.

Seamlessly adapt to your evolving API needs, ensuring efficiency at any scale.

Effortlessly transition with robust tools for smooth API onboarding processes.

Schedule recurring tasks effortlessly with our intuitive job management.

Streamline operations with seamless command line interface compatibility.

Unlock cutting-edge capabilities with our innovative experimental toolkit.

Fuel your curiosity, expand your horizons, and achieve greatness by joining a vibrant community of learners.

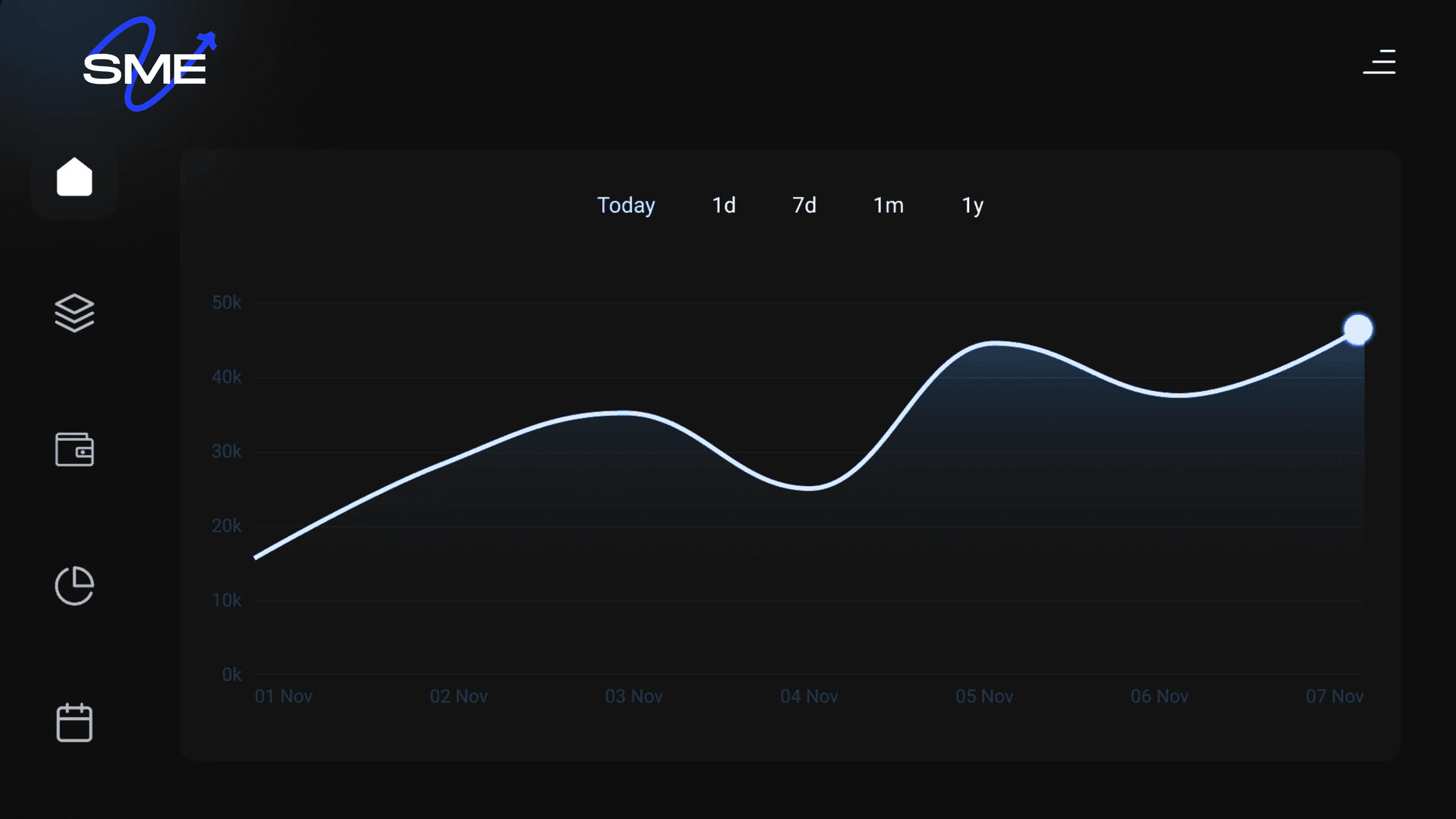

SME Credit Scoring Metrics

Financial Trends

Fraud Analysis

Discover what our users say about the transformative impact of our tool.

The Synergy of Credit Risk Engines and Embedded Banking Services

Read More

Optimizing Business Processes with API Management: A Strategic Approach

Read More

Demystifying API Management: A Comprehensive Guide for New Beginners

Read More

Faq

What is SMEApprove?

How does your tool ensure data privacy and security?

Can I seamlessly integrate with my existing platform?

Can SMEApprove help in continuous monitoring of credit risk?

3. What technologies does SMEApprove use for credit risk assessment?